Operation Sindoor: A Case Study in Investor Psychology

Introduction

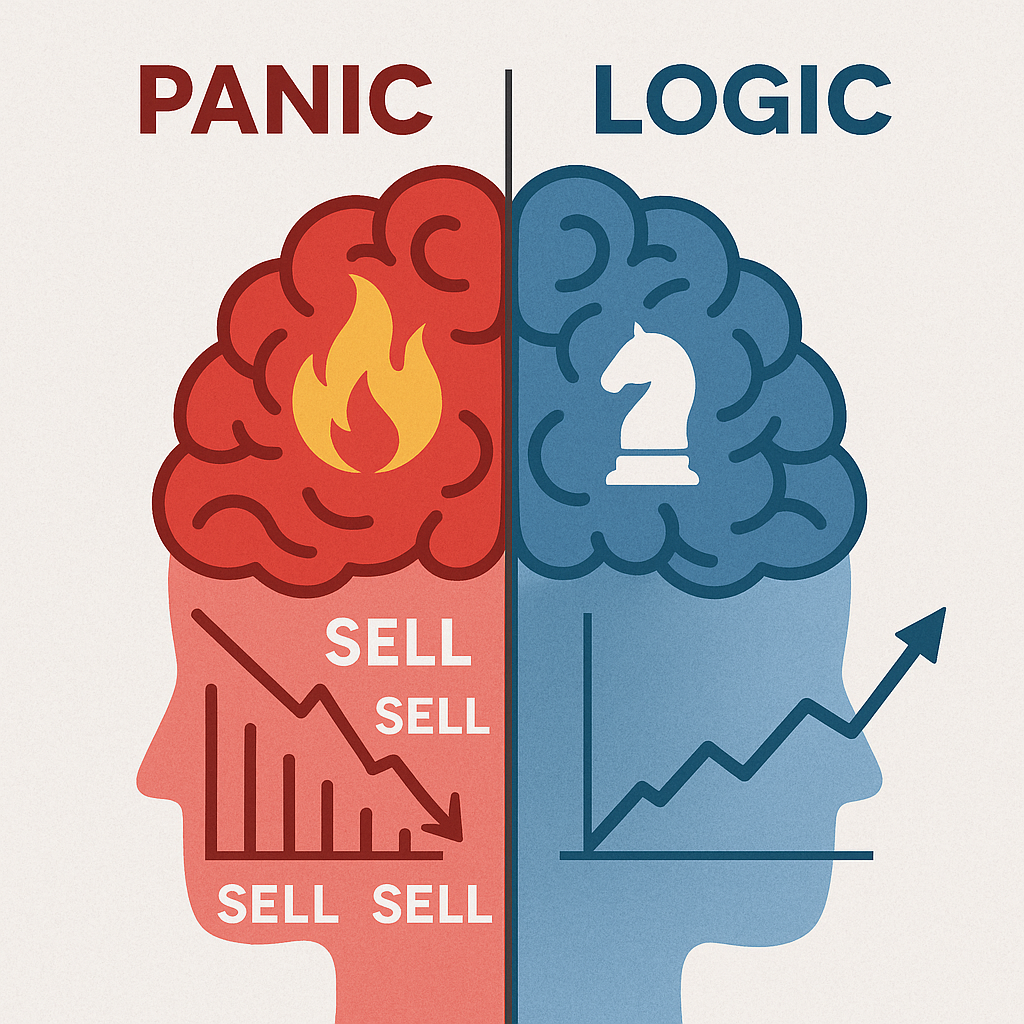

When news of Operation Sindoor come out in front of every one, Indian markets reacted with predictable volatility—But what really mattered wasn’t just the numbers — it was the behavior and emotions behind them. At Bluechip Institute, we recognize such events as invaluable lessons in investor psychology. This analysis goes beyond surface-level market movements to examine how human behavior shapes financial outcomes, and how disciplined investors can navigate geopolitical shocks.

The Anatomy of a Market Panic

Group Panic Reactions

- Retail investors rushed to exit positions, mirroring others’ fear

- Trading volumes spiked 30% on derivative unwinding

Fear of Losing Money

- Investors sold quality holdings to “stop the bleeding”

- The Nifty Midcap index saw exaggerated declines versus large-caps

Focusing on Negativity

- Media amplified negative narratives

- Investors selectively processed bearish analyst comments

Key Data Point

India VIX surged 42% intraday before stabilizing

Institutional vs. Retail: A Study in Contrasts

Retail Behavior

- High-beta stocks: Stocks that are more sensitive to market changes — they rise higher in good times but fall harder in bad times.

- Recent IPO listings: Shares of companies that just launched on the stock market — often more volatile and uncertain.

- Small-cap momentum plays: Smaller companies that had been gaining quickly in price, often attracting short-term traders.

Smart Money Moves

Panic selling concentrated in:

FIIs used the dip to accumulate:

- Banking sector leaders: Big, reliable banks that usually lead the financial market.

- Select defensive stocks: Safe, steady stocks like those in healthcare or utilities that people rely on no matter what’s happening in the economy.

- Oversold quality midcaps: Good mid-sized companies that were unfairly hit and became available at bargain prices.

Bluechip Insight

“The gap between institutional and retail responses highlights the value of emotional discipline.”

Historical Context: Why This Matters

| Event | Initial Drop | Recovery Time | Key Difference |

| Operation Sindoor | 3.8% | 9 trading days | Retail-driven volatility |

| 2019 Balakot | 2.1% | 5 days | Less retail participation |

| 2008 Crisis | 12% | 18 months | Fundamental breakdown |

Critical Insight

Geopolitical events create temporary dislocations, not structural damage.

Turning Crisis into Opportunity

For Investors

- Implement the 72-Hour Rule before making portfolio changes

- Identify oversold quality stocks using:

- RSI below 30

- Institutional accumulation patterns

- RSI below 30

- Rebalance toward sectors with:

- Low geopolitical sensitivity

- Strong domestic demand

- Low geopolitical sensitivity

For Traders

- Smart Trading During Turbulent Times strategies

- Investing in Steps

- Setting Clear Exit Points

Conclusion: The Psychology of Resilience

Operation Sindoor reaffirms three timeless principles:

- Markets overreact to geopolitical shocks

- Emotional decisions create opportunity for the disciplined

- Context matters more than headlines

Bluechip Perspective

“This event perfectly demonstrates why we teach behavioral finance alongside technical analysis.”