Gold as a Safe Haven Asset in 2025: Insights for Investors & Trading Aspirants in Bhopal

Gold has always stood tall when markets fall.

In 2025, the world is once again treating gold as a safe haven asset — a shelter during economic storms.

But is this glitter grounded in value, or is investor confidence overstretched?

What’s Fueling Gold’s Surge in 2025?

The U.S.-China tariff war has pushed uncertainty across borders.

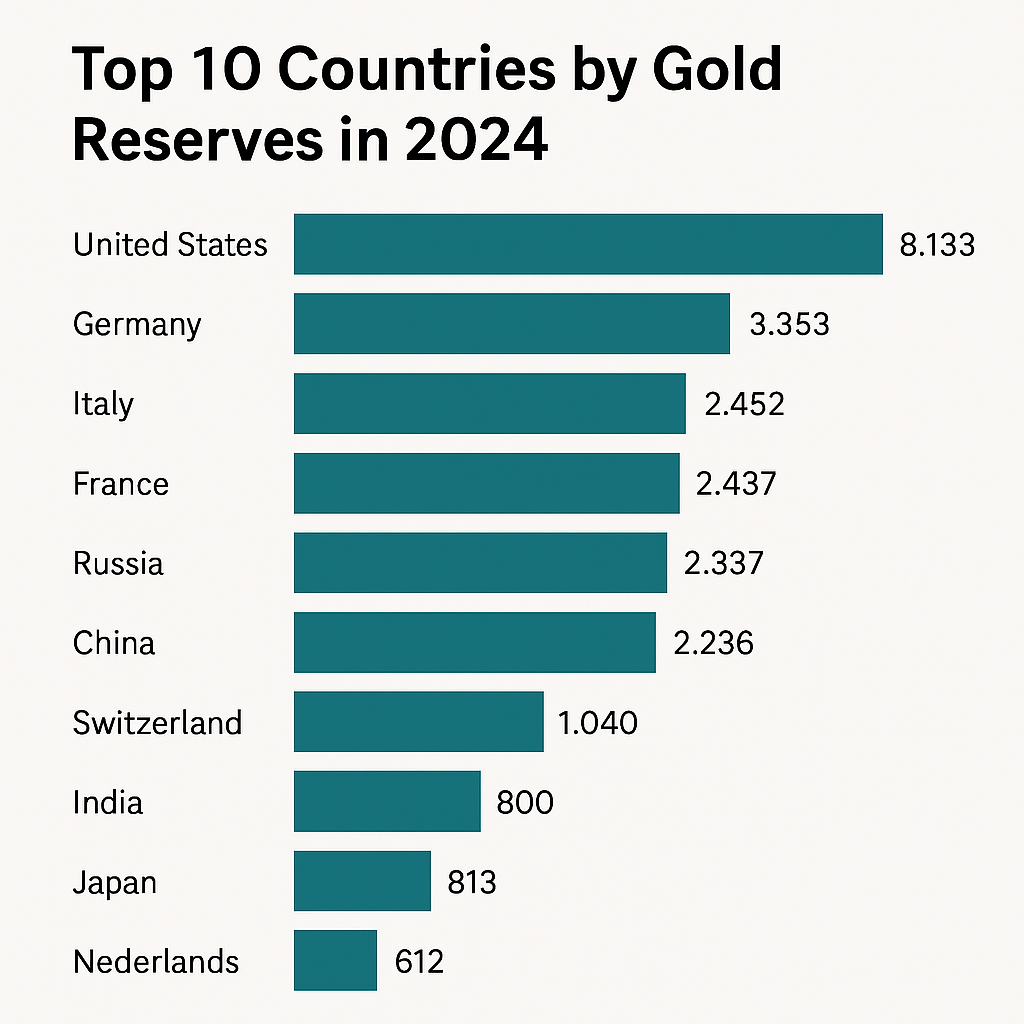

Central banks globally added over 1,180 tonnes of gold to their reserves in 2024 — a historic move.

As trust in the dollar weakens, gold shines brighter in comparison.

Top 10 Countries by Gold Reserves (2025): A visual breakdown of global gold holdings, showcasing rising demand for gold as a safe haven asset.

Japan and China reducing U.S. Treasury holdings has also shaken global markets.

With the dollar slipping, gold’s inverse relation kicked in — pushing its price even higher.

And in times of geopolitical tension, investors naturally drift to safer bets.

This global gold rush isn’t just emotion — it’s a strategic shift in how economies hedge risk.

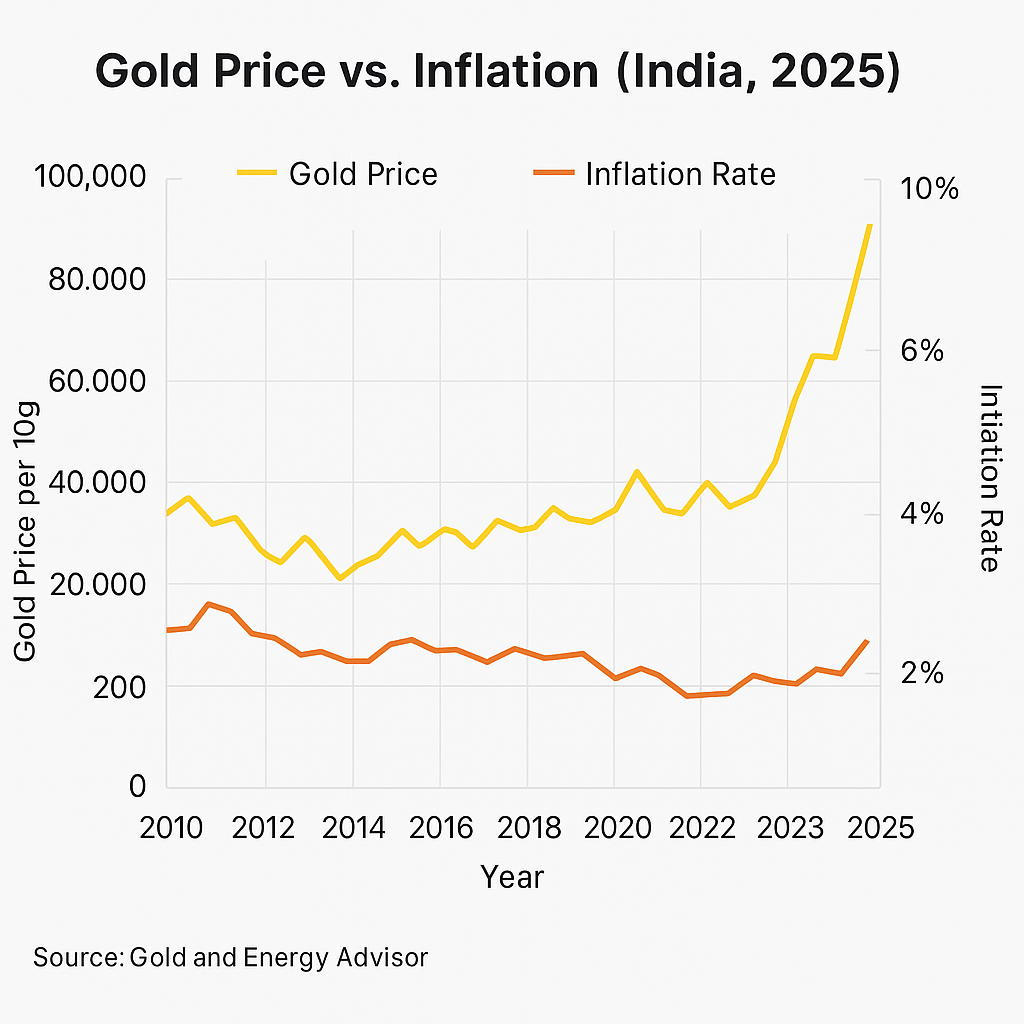

Gold Price vs Inflation: Is the Rise Justified?

Gold price vs inflation is a classic conversation among economists and traders.

In 2025, while inflation rises globally, gold prices have surged even faster.

Currently hovering around ₹95,000 per 10g, some forecasts suggest ₹1,25,000 isn’t far off.

But here’s the caution: When inflation cools and calm returns, prices may face a correction.

Understanding this dynamic is key for anyone learning to trade or invest.

Is Gold Trading Above Its Intrinsic Value?

History shows gold can’t stay detached from fundamentals for too long.

At some point, price corrections balance out investor emotion and actual value.

Even safe haven assets have their limits.

What Should Trading Learners in Bhopal Take From This?

For aspiring investors in Bhopal, this is more than just market news — it’s a live learning opportunity.

At Bluechip Institute, we use such real-time cases to teach:

- Trading psychology – understanding emotional behavior during volatility

- Market trend analysis – spotting entry and exit signals

- Difference between trading and investing – timing vs holding mindset

Seeing the visual relationship between rising inflation and gold trends enhances conceptual clarity — something we focus on in our live sessions.

The Smart Investor Mindset: Diversification Wins

While gold investment strategies offer protection, real wealth lies in balance.

Stocks, IPOs, and commodities all have roles in a diversified portfolio.

We help students understand where gold fits — and where it doesn’t.

Whether it’s how to invest in IPOs, track stock momentum, or learn price action trading,

you’ll gain hands-on insight from market-tested mentors.

Bluechip Institute – Building Bhopal’s Next-Gen Investors

Our focus isn’t just on theory, but on application.

From classroom simulations to real-market discussions, we teach what matters:

- How to read the market, not follow the noise

- How to use trading strategies when prices spike or crash

- How to build confidence and skill as a retail investor in India

If you’re in Bhopal and want to truly learn stock market tactics — this is your sign.

Conclusion: Gold’s Shine Teaches Us More Than Its Price

Gold may be the talk of 2025, but the real takeaway is deeper.

Understanding why investors run to gold helps shape a smarter, calmer, and more confident trader.

At Bluechip Institute, we don’t just teach tools — we build investor mindset.

Ready to Learn Beyond the Headlines?

Join our stock market classes in Bhopal and explore how professionals analyze, act, and adapt to ever-shifting markets.

Visit Bluechip Institute →

❓ FAQs

Q1: Why is gold called a safe haven asset?

Because it maintains value in times of economic crisis or market fear — especially when fiat currencies weaken.

Q2: How does gold price compare to inflation in 2025?

Gold has risen faster than inflation this year, but its future depends on how long uncertainty lasts.

Q3: Is it safe to invest in gold now?

Gold offers protection, but no asset is risk-free. A well-diversified portfolio is always recommended.

Q4: How can Bluechip Institute help me learn this better?

We offer practical stock market training in Bhopal focused on trading psychology, trend analysis, and hands-on strategy.

Title : Gold as a Safe Haven in 2025 | Learn Trading in Bhopal

Description: Discover why gold is a safe haven asset in 2025. Bluechip Institute Bhopal helps you trade smarter—enroll in our stock market courses now!